Rumored Buzz on Kam Financial & Realty, Inc.

Rumored Buzz on Kam Financial & Realty, Inc.

Blog Article

An Unbiased View of Kam Financial & Realty, Inc.

Table of ContentsSome Ideas on Kam Financial & Realty, Inc. You Should KnowThe Kam Financial & Realty, Inc. PDFsHow Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.Getting My Kam Financial & Realty, Inc. To WorkGetting The Kam Financial & Realty, Inc. To WorkIndicators on Kam Financial & Realty, Inc. You Need To Know

When one takes into consideration that home mortgage brokers are not needed to submit SARs, the actual quantity of mortgage scams activity might be a lot higher. (https://leetcode.com/u/kamfnnclr1ty/). As of early March 2007, the Federal Bureau of Examination (FBI) had 1,036 pending home mortgage fraudulence investigations,4 compared to 818 and 721, respectively, in the 2 previous yearsThe mass of home loan fraudulence drops right into 2 wide classifications based upon the motivation behind the scams. usually includes a debtor who will overstate revenue or asset values on his/her financial statement to get a financing to buy a home (mortgage lenders in california). In most of these situations, assumptions are that if the revenue does not increase to satisfy the payment, the home will certainly be cost an earnings from appreciation

More About Kam Financial & Realty, Inc.

The huge bulk of fraud instances are found and reported by the institutions themselves. According to a research study by BasePoint Analytics LLC, broker-facilitated fraudulence has emerged as one of the most prevalent section of mortgage fraudulence nationwide.7 Broker-facilitated home mortgage fraudulence occurs when a broker materially misrepresents, misstates, or leaves out details that a loan policeman depends on to make the decision to extend credit score.8 Broker-facilitated fraud can be fraud for residential property, fraud for profit, or a combination of both.

The adhering to stands for an instance of fraudulence commercial. A $165 million area financial institution chose to go into the home loan financial service. The financial institution acquired a little home mortgage firm and worked with an experienced home mortgage lender to run the procedure. Virtually 5 years into the connection, a financier notified the bank that numerous loansall stemmed through the very same third-party brokerwere being returned for repurchase.

9 Easy Facts About Kam Financial & Realty, Inc. Described

The bank alerted its primary federal regulatory authority, which then called the FDIC as a result of the prospective influence on the bank's monetary problem ((https://www.brownbook.net/business/53307872/kam-financial-realty-inc/). Further investigation exposed that the broker was operating in collusion with a building contractor and an evaluator to turn residential properties over and over once more for higher, illegitimate earnings. In total amount, even more than 100 car loans were originated to one contractor in the same subdivision

The broker refused to make the settlements, and the case entered into lawsuits. The financial institution was eventually granted $3.5 click this link million. In a subsequent conversation with FDIC supervisors, the financial institution's head of state suggested that he had always heard that one of the most tough part of mortgage banking was making certain you executed the right bush to balance out any type of rate of interest risk the financial institution may incur while warehousing a significant quantity of mortgage car loans.

The 3-Minute Rule for Kam Financial & Realty, Inc.

The bank had depiction and warranty provisions in agreements with its brokers and thought it had recourse with regard to the financings being stemmed and marketed through the pipeline. Throughout the lawsuits, the third-party broker suggested that the financial institution needs to share some responsibility for this exposure due to the fact that its internal control systems ought to have acknowledged a loan concentration to this community and set up steps to prevent this threat.

What we call a month-to-month home mortgage payment isn't simply paying off your home loan. Instead, think of a monthly mortgage settlement as the 4 horsemen: Principal, Rate Of Interest, Building Tax Obligation, and House owner's Insurance coverage (called PITIlike pity, because, you understand, it increases your settlement).

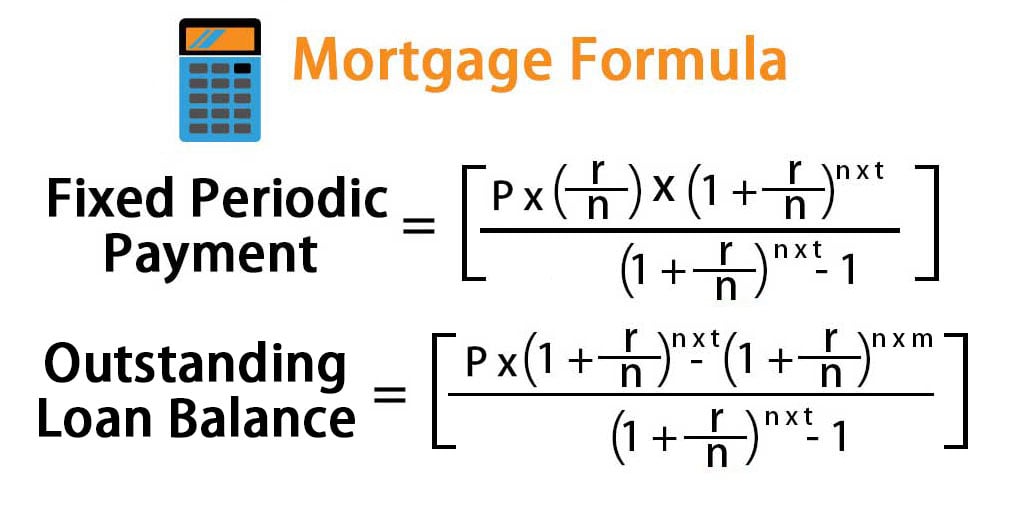

Hang onif you assume principal is the only amount to consider, you would certainly be failing to remember regarding principal's ideal friend: passion. It 'd behave to believe lenders allow you borrow their cash even if they like you. While that may be real, they're still running an organization and want to place food on the table as well.

The 9-Minute Rule for Kam Financial & Realty, Inc.

Passion is a percentage of the principalthe quantity of the car loan you have actually entrusted to settle. Interest is a percentage of the principalthe amount of the finance you have actually left to repay. Home loan rates of interest are constantly altering, which is why it's clever to choose a home mortgage with a fixed passion price so you know how much you'll pay each month.

That would certainly indicate you 'd pay a monstrous $533 on your very first month's home loan payment. Obtain prepared for a little bit of math below.

The Best Strategy To Use For Kam Financial & Realty, Inc.

That would make your month-to-month home loan settlement $1,184 monthly. Month-to-month Principal $1,184 $533 $651 The next month, you'll pay the very same $1,184, however less will most likely to rate of interest ($531) and extra will most likely to your principal ($653). That fad continues over the life of your home mortgage until, by the end of your home loan, almost all of your payment goes toward principal.

Report this page